24

يونيوKey Distinctions Between Irreversible Living Trusts and Revocable Living Trust Funds

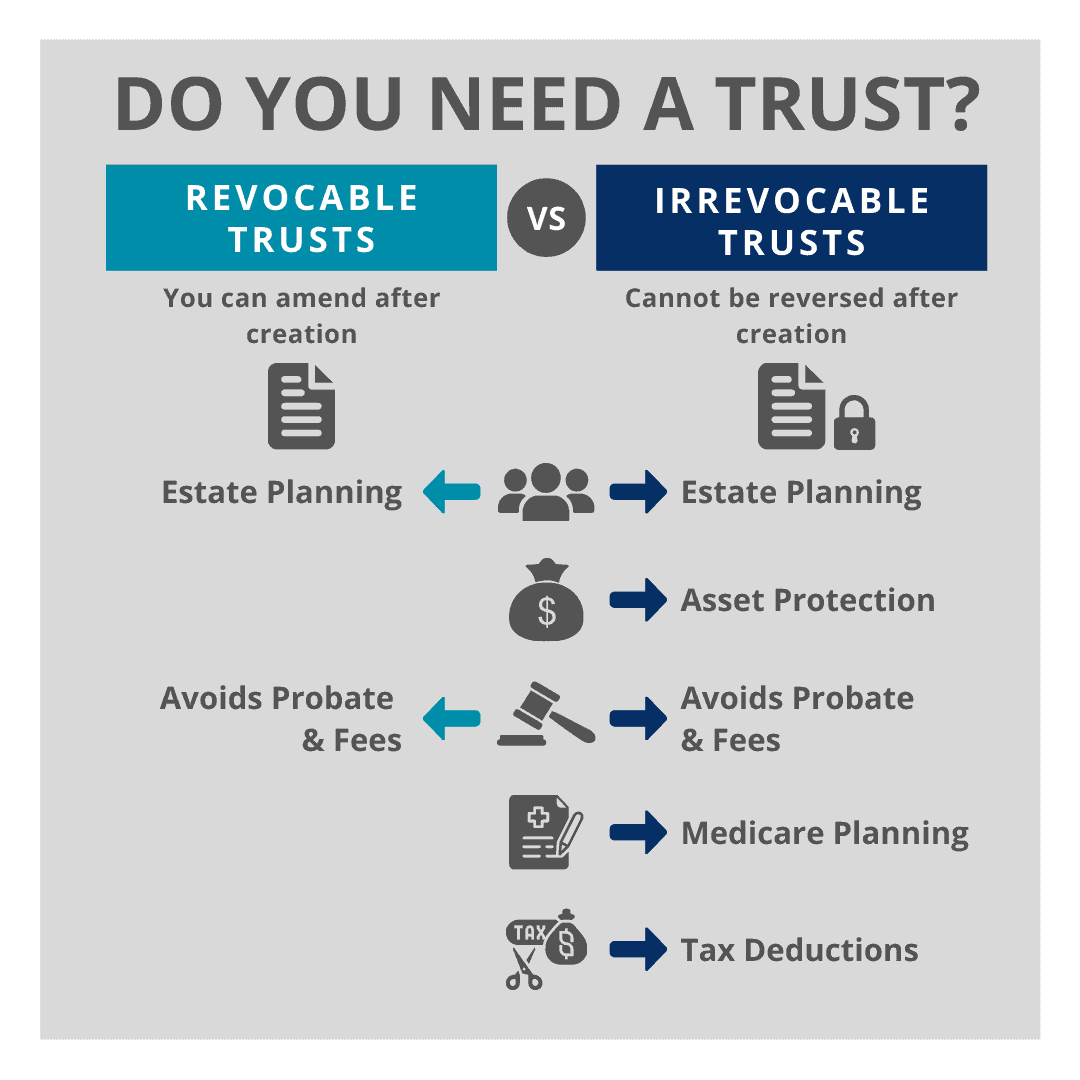

Unalterable living counts on and revocable living trusts are two typical estate preparation devices used in the United States, each with its very own collection of benefits and factors to consider. Comprehending the crucial differences between these two kinds of depends on is necessary for individuals seeking to produce a reliable estate strategy.

One considerable difference between an unalterable living trust fund and a revocable living count on is the capability to make modifications to the depend on record. With a revocable living trust fund, the grantor maintains the adaptability to change or revoke the count on during their life time. This implies that the grantor can modify the trust terms, include or eliminate beneficiaries, or alter the distribution of possessions as needed. In comparison, an irreversible living depend on normally can not be modified or revoked once it is developed, supplying greater durability and possession security.

Possession security is an additional key distinction between irrevocable and revocable living trusts. In comparison, assets moved into an unalterable living trust are usually shielded from financial institutions and suits, providing greater defense for the grantor's riches.

Additionally, there are differences in tax obligation treatment in between irreversible and revocable living trusts. In comparison, possessions transferred right into an unalterable living trust fund are generally removed from the grantor's taxed estate, possibly reducing estate tax obligations upon the grantor's fatality.

However, it's necessary to think about the trade-offs associated with what does irrevocable trust mean living counts on. As soon as possessions are transferred right into an unalterable depend on, they typically can not be recovered by the grantor. This loss of control over trust fund possessions can be a considerable factor to consider for individuals reluctant to part with decision-making authority over their possessions. In addition, moneying an irrevocable trust might affect liquidity and monetary versatility, as possessions placed in the trust are no more readily obtainable for individual use.

In final thought, comprehending the vital differences in between unalterable and revocable living counts on is essential for people looking for to create an efficient estate plan. While both sorts of counts on offer beneficial advantages, such as property protection and tax obligation advantages, they likewise include their very own set of factors to consider. Consulting with skilled lawful and financial experts can an irrevocable trust be terminated assist individuals identify which kind of trust fund is the most effective fit for their particular needs and objectives.

One substantial difference in between an irrevocable living trust fund and a revocable living depend on is the capacity to make adjustments to the count on file. With a revocable living count on, the grantor preserves the flexibility to modify or withdraw the depend on during their life time. In comparison, assets transferred right into an unalterable living trust are typically removed from the grantor's taxable estate, potentially lowering estate tax obligation liabilities upon the grantor's death. Furthermore, moneying an irrevocable trust may impact liquidity and financial versatility, as properties positioned in the depend on are no much longer readily available for personal usage.

One substantial difference in between an irrevocable living trust fund and a revocable living depend on is the capacity to make adjustments to the count on file. With a revocable living count on, the grantor preserves the flexibility to modify or withdraw the depend on during their life time. In comparison, assets transferred right into an unalterable living trust are typically removed from the grantor's taxable estate, potentially lowering estate tax obligation liabilities upon the grantor's death. Furthermore, moneying an irrevocable trust may impact liquidity and financial versatility, as properties positioned in the depend on are no much longer readily available for personal usage.