11

يوليوUnderstanding Irrevocable Trust Fund Beneficiaries in the US

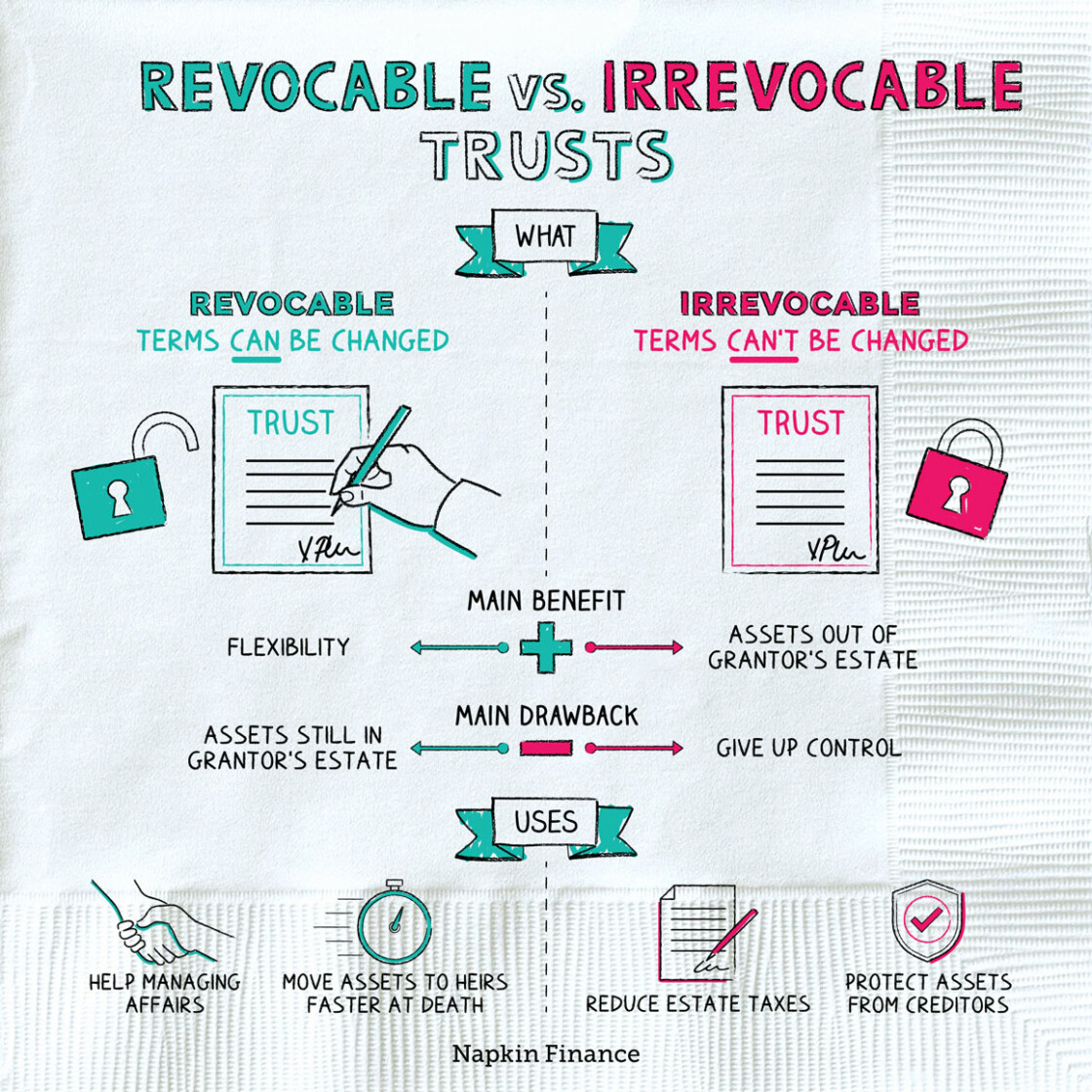

Irreversible trust funds are estate planning tools that involve transferring possessions into a depend on for the advantage of assigned beneficiaries. In the USA, comprehending the functions and rights of irreversible trust fund beneficiaries is important for both grantors and recipients themselves. Below are essential aspects connected to unalterable trust fund recipients:

Classification: The grantor of an irrevocable trust fund marks several recipients that will certainly gain from the trust fund possessions. Recipients can be people, charities, or even entities such as other depends on or organizations.

Legal rights and Advantages: Unalterable trust recipients have specific civil liberties and advantages depending on the terms of the count on agreement. These may consist of the right to get revenue produced by count on assets, the right to receive distributions of trust fund principal, or other defined benefits detailed in the count on record.

Fiduciary Duty: Trustees of what does irrevocable trust mean trust funds have a fiduciary task to act in the most effective interests of the beneficiaries. This duty requires trustees to handle depend on assets wisely, invest them intelligently, and meet the terms of the trust contract for the advantage of the beneficiaries.

Trustee Discernment: Sometimes, irreversible trust documents grant trustees discernment pertaining to circulations to beneficiaries. Trustees might have the authority to choose regarding when and just how to disperse earnings or principal based upon factors such as the recipients' needs, monetary situations, and the grantor's intents.

Notice and Reporting: Irreversible depend on recipients can be informed concerning the trust's presence, terms, and management. Trustees are commonly needed to provide beneficiaries with periodic bookkeepings and records outlining the depend on's properties, revenue, expenditures, and distributions.

Modification or Discontinuation: Depending on the particular terms of the living trust vs irrevocable trust fund agreement and appropriate state legislations, irrevocable count on recipients may have the capacity to seek the court to change or end the count on under certain scenarios. However, adjustment or discontinuation of an unalterable depend on can be complex and may call for court authorization.

In final thought, irreversible depend on beneficiaries play a crucial duty in the management and distribution of trust properties in the US. Comprehending the legal rights, obligations, and prospective benefits of being a beneficiary is crucial for individuals associated with irrevocable trust funds, whether as grantors or recipients themselves. Consulting with skilled legal and monetary experts can help guarantee that irrevocable trusts are structured and administered in a manner that aligns with the interests of all parties included.

irrevocable trust trustee counts on are estate planning tools that include moving possessions right into a depend on for the advantage of assigned recipients. In verdict, irreversible trust recipients play a vital function in the management and distribution of count on possessions in the US. Comprehending the civil liberties, obligations, and prospective benefits of being a recipient is crucial for individuals included in unalterable trusts, whether as grantors or recipients themselves.