11

يوليوJust how to Establish an Irrevocable Living Rely On the United States

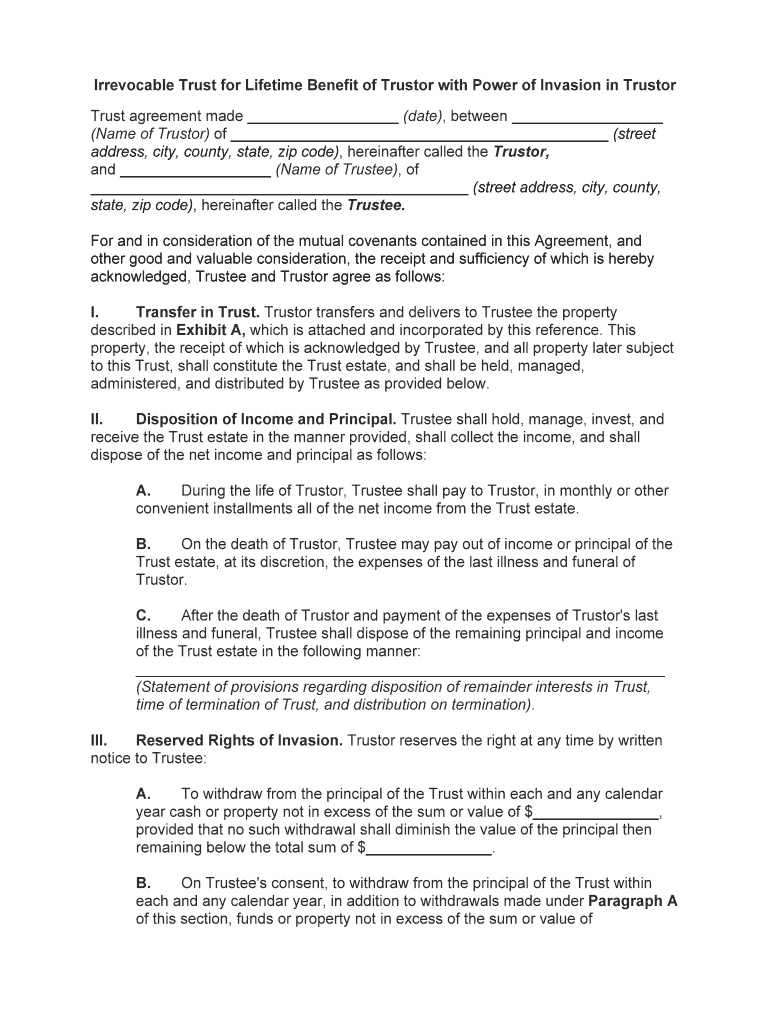

Establishing an irrevocable trust florida living count on can a grantor be a beneficiary of an irrevocable trust be a vital part of detailed estate preparation for people in the United States. This legal file enables individuals to protect their properties, reduce inheritance tax, and make sure the orderly circulation of their wide range to recipients. Below are the necessary actions to establish an unalterable living trust fund:

Establishing an irrevocable trust florida living count on can a grantor be a beneficiary of an irrevocable trust be a vital part of detailed estate preparation for people in the United States. This legal file enables individuals to protect their properties, reduce inheritance tax, and make sure the orderly circulation of their wide range to recipients. Below are the necessary actions to establish an unalterable living trust fund:

Determine Your Objectives: Before producing an irreversible living trust fund, it's important to determine your estate preparing objectives. Think about variables such as property protection, tax minimization, and supplying for enjoyed ones. Recognizing your purposes will certainly assist assist the structure and terms of the count on.

Choose a Trustee: The trustee is in charge of taking care of the count on assets and guaranteeing that the regards to the trust fund are carried out according to your wishes. You can assign yourself as the trustee or pick a trusted individual, specialist trustee, or irrevocable trust business to serve in this duty.

Compose the Trust Record: Collaborate with a seasoned estate planning attorney to prepare the count on paper. The document should describe the conditions of the count on, including the recipients, circulation of properties, and any kind of certain instructions or constraints.

Fund the Depend on: Transfer assets into the depend on by re-titling them for the trust fund. This might consist of realty, savings account, financial investments, and various other useful possessions. Make certain to comply with all lawful requirements and procedures for moving possession of properties to the trust fund.

Indication and Execute the Trust: Once the trust fund paper is composed and the properties are funded, you need to sign and carry out the rely on accordance with state regulations. Depending upon state needs, this might involve having the paper notarized and/or observed by witnesses that are not recipients of the trust.

Update Beneficiary Designations: Evaluation and update beneficiary classifications on pension, life insurance policy policies, and other possessions to guarantee they straighten with the terms of the count on. Possessions that go by beneficiary classification might bypass the probate procedure yet should be coordinated with the total estate plan.

Keep the Count on: After developing the irreversible living depend on, it is very important to keep track of and take care of the trust properties over time. This may entail working carefully with the trustee, assessing financial investment techniques, and periodically updating the depend on file to reflect modifications in situations or objectives.

Establishing an irreversible living count on can be a complex lawful procedure, so it's vital to collaborate with skilled experts, such as estate preparation attorneys and financial experts, to make sure that the trust is structured correctly and aligned with your total estate planning purposes.

Developing an irreversible living trust fund can be a crucial element of comprehensive estate planning for people in the United States. Fund the Trust: Transfer possessions into the count on by re-titling them in the name of the count on. Be certain to comply with all legal demands and procedures for transferring possession of properties to the trust.