13

يوليوRecognizing Irrevocable Trust Recipients in the US

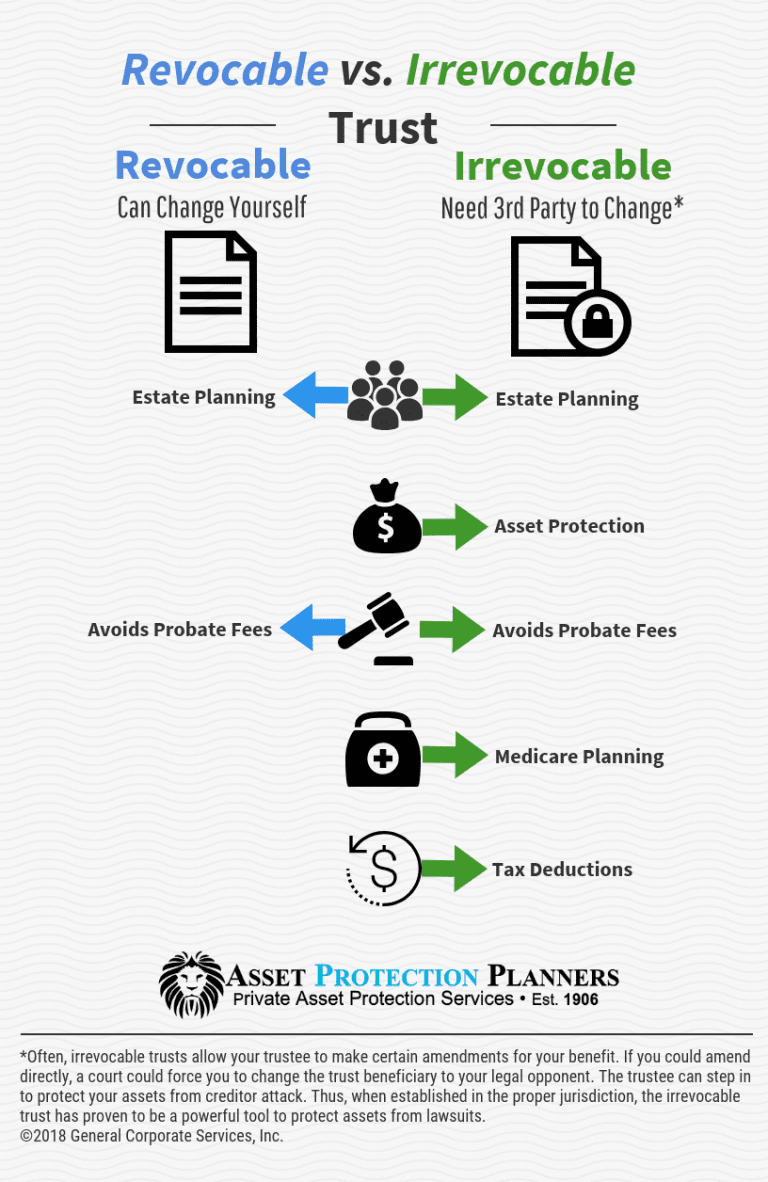

Irreversible trust funds are estate planning devices that involve moving properties right into a trust fund for the advantage of marked beneficiaries. In the USA, understanding the duties and legal rights of irrevocable trust disadvantages count on recipients is vital for both grantors and recipients themselves. Right here are crucial facets associated with irrevocable trust recipients:

Classification: The grantor of an irrevocable trust fund assigns several beneficiaries that will certainly benefit from the trust distributing assets from an irrevocable trust. Beneficiaries can be individuals, charities, or even entities such as various other counts on or companies.

Civil liberties and Benefits: Irreversible count on recipients have certain legal rights and advantages depending upon the regards to the trust fund agreement. These might include the right to obtain income produced by trust possessions, the right to get distributions of trust principal, or various other defined advantages detailed in the trust fund record.

Fiduciary Obligation: Trustees of irrevocable trusts have a fiduciary task to act in the finest interests of the beneficiaries. This task requires trustees to manage trust fund assets prudently, spend them wisely, and satisfy the regards to the trust fund arrangement for the advantage of the recipients.

Trustee Discernment: In some cases, unalterable count on records grant trustees discernment pertaining to circulations to beneficiaries. Trustees may have the authority to make choices regarding when and how to distribute revenue or principal based upon aspects such as the recipients' demands, economic scenarios, and the grantor's purposes.

Notice and Coverage: Irreversible trust beneficiaries can be notified about the depend on's presence, terms, and administration. Trustees are typically called for to supply beneficiaries with periodic bookkeepings and records outlining the count on's properties, income, expenses, and circulations.

Adjustment or Termination: Relying on the details terms of the depend on contract and relevant state legislations, unalterable trust fund beneficiaries may have the ability to petition the court to modify or end the trust under specific situations. However, adjustment or termination of an irrevocable depend on can be intricate and may need court approval.

Finally, irrevocable count on beneficiaries play an essential function in the management and distribution of trust possessions in the US. Understanding the civil liberties, obligations, and prospective advantages of being a recipient is vital for individuals associated with unalterable depends on, whether as grantors or beneficiaries themselves. Consulting with knowledgeable lawful and financial professionals can aid make sure that unalterable trust funds are structured and administered in a manner that aligns with the rate of interests of all parties entailed.

Irrevocable trust funds are estate preparation tools that entail moving properties right into a count on for the benefit of marked beneficiaries. In final thought, irrevocable trust recipients play a crucial function in the management and circulation of depend on assets in the US. Understanding the legal rights, obligations, and prospective advantages of being a beneficiary is necessary for individuals included in irrevocable trust funds, whether as grantors or beneficiaries themselves.

Irrevocable trust funds are estate preparation tools that entail moving properties right into a count on for the benefit of marked beneficiaries. In final thought, irrevocable trust recipients play a crucial function in the management and circulation of depend on assets in the US. Understanding the legal rights, obligations, and prospective advantages of being a beneficiary is necessary for individuals included in irrevocable trust funds, whether as grantors or beneficiaries themselves.